Understanding Cognitive Counter-Fraud, Waste and Abuse

Greg Greben, Vice President and Client Group Leader, Federal Civilian & Healthcare Agencies, IBM Global Business Services, authored this article

In parallel, the private sector has used fraud, waste, and abuse (FWA) detection capabilities to unlock significant ongoing savings and identify operational vulnerabilities. While the U.S. federal government has employed these services with impressive outcomes in recent years, federal agencies in fiscal 2015 made an estimated $137 billion in improper payments, and more than $1.137 trillion since 2004, according to the Technology CEO Council’s January 2017 report.

To better understand counter-fraud and the opportunities to drive substantive savings, it is helpful to define FWA and other related terminology. FWA often is used as an umbrella term to define fraud or fraud-like activities that typically result in improper payments. Federal agencies, though, experience FWA in a variety of situations that include:

- False statement on claims or “up-coding” to higher payments for given services;

- Hidden facts or events that affect eligibility for social benefits;

- Misuse of benefits by a representative payee;

- Identify theft; and

- Other scams, anomalies, and misrepresentations.

FWA leads to improper payments, which refer to the financial losses that undermine program integrity and are generally the goal of those involved in FWA. Typically, improper payments are defined as avoidable payments that are not mandated by statutes, regulations, and court orders. The following events often are contributing factors to improper payments:

- Mistake computing a payment or reimbursement of a claim;

- Failure to obtain or act on available information affecting payment or disbursement of a

- benefit;

- Beneficiary or claimant failure to report an event; or

- Beneficiary or claimant incorrect report.

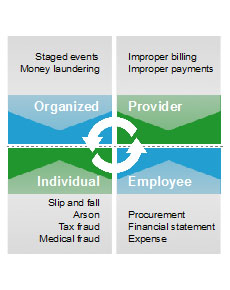

Fraud is different from waste and abuse, as it generally implies intent, rather than negligence or simple errors as the graphic below depicts:

Fraud may be driven by carelessness, omission of key facts, or direct intent to defraud the government – all of which lead to money wasted and/or lost by the government.

Program integrity (PI) is a term often used to confirm compliance, efficiency, and accountability within government agencies by monitoring and preventing program FWA and by verifying that dollars are appropriately paid. The goal of PI efforts is to minimize improper payments across government programs and goes hand-in-hand with good government. However, the question for many federal agencies is how to identify viable solutions to reduce improper payments. Federal government organizations typically do not have the resources to monitor, detect, and investigate emerging fraud practices. Advancements in cloud computing and cognitive analytics provide the opportunity to enhance traditional methods to achieve greater results.

Some areas in which there are substantial amounts of FWA within the government include:

- Medicare and Medicaid

- Tax and revenue

- Workers compensation

- Unemployment insurance

- Food and nutrition programs

- Procurement

- Insider threats

Federal Success Stories

Recently, large federal agencies have focused on FWA as a means to significantly reduce improper payments resulting in significant agency/department mission and tax payer value. There are many known success stories in the federal government, a few of which are included below:

- Department of Veteran’s Affairs Veteran Health Administration (VHA): The Purchased Care Organization at the VHA pays about $10 billion annually for medical care from providers outside VA hospitals. The VA Office of Inspector General’s estimates that up to 12 percent of these payments may be improper, including FWA. VHA developed and maintains a solution to receive claims from source claim systems, house them in a central repository, analyze them for the risk of FWA, and send them back to the source claim systems.

- Center for Medicare and Medicaid Services (CMS): CMS deploys several counter-fraud solutions, including predictive modeling and other analytics support to the National Fraud Prevention Program at the Center for Program Integrity. This includes the development of predictive models for deployment in the fraud prevention system, and analytics support for other program integrity initiatives.

- Social Security Administration (SSA): SSA recently awarded an anti-fraud enterprise solution. Under this initiative, SSA will develop the processes, technology, and analytics to support fraud detection across SSA’s various programs. SSA is implementing a commercial counter-fraud software solution in addition to services that establish and deploy an enterprise risk framework.

- Internal Revenue Service (IRS): The IRS’s return review program (RRP) uses predictive fraud analytics to detect fraudulent tax returns as well as to identity tax payer or preparer theft. RRP reviews, analyzes, and stops refunds from being paid in real time if they are suspected of being fraudulent.

As well, many state Medicaid agencies have deployed successful counter-fraud analytics solutions, including predictive models; rules-based expert systems; network analysis; advanced analytic models; pre-pay methodologies; policy development; case management and tracking; recoveries; provider self-audit, and training and education components.

An opportunity exists to take further advantage of these efforts by incorporating recent advances in cognitive analytics and cloud computing. Cognitive tools – that understand, reason, learn and interact with humans naturally - offer insights into unstructured data not discernible with previous technologies. This capability makes a compelling case for the adoption of a cognitive counter-fraud, waste and abuse (CCFWA) approach.

Combating FWA in real time using CCFWA enables governments to stop payments rather than trying to “pay and chase,” which has been the default approach to reduce FWA. “Pay and chase” is inherently inefficient, given the transitory nature of FWA participants and the complexity of the transactions. Recoveries, when they occur, often take years to complete and substantially increase the costs associated with a FWA program.

The U.S. government - and U.S. taxpayers - are perhaps the largest victims of fraud in the world. Given the large numbers of payments the government makes to a diverse set of individuals, it is a natural target and nearly every government agency and program battles fraud on a daily basis.

The costs are staggering; for example:

- The U.S. Treasury Inspector General for Tax Administration reports that the improper payment for the earned income tax credit for 2013 was 22 to 26 percent, costing taxpayers $13.3 - $15.6 billion.[1]

- The Government Accounting Office estimates that in 2014, 10 percent of Medicare’s budget was spent on improper, potentially fraudulent claims.[2]

- The Internal Revenue Service estimates that the “tax gap” - the difference between what is owed and what is paid - was $406 billion for tax years 2008 – 2010 (the most recent report).[3]

Addressing the problem with cognitive computing can enable better decisions through real-time understanding of key information found in large and distributed data sets. Instant analysis enables governments to stop payments before they are made, significantly reducing the amount of fraud and the costs to recover.

State governments and the private sector have recognized the benefit of enterprise-wide collaboration to further enhance CCFWA. A central platform to store and analyze transactions for FWA enables cross-agency learning and capitalizes on the findings of one agency. For example, a health care provider engaged in an “up-coding” scheme to improperly increase reimbursements may also be engaged in other types of fraud in its government interactions. Many times, networks or groups work together to exploit a weakness. A centralized CCFWA platform can enable quicker identification of these groups of fraudsters. Reducing information silos and enabling sharing can greatly increase recoveries and serve as a deterrent to future abuses. Expanding these efforts to include state governments and commercial organizations would further enhance the efficacy of FWA initiatives.

Part II of this blog addresses government challenges; cognitive counter-fraud, waste, abuse defined; and next steps.

[1] GAO report dated Dec 9, 2014, “Improper Payments: Inspector General Reporting of Agency Compliance under the Improper Payments Elimination and Recovery Act”

[2] GAO report dated March 4, 2015, “GOVERNMENT EFFICIENCY AND EFFECTIVENESS Opportunities to Reduce Fragmentation, Overlap, Duplication, and Improper Payments and Achieve Other Financial Benefits”

[3] IRS report dated May, 2016, “Federal Tax Compliance Research: Tax Gap Estimates for Tax Years 2008–2010.